Kern County Sales Tax 2025

BlogKern County Sales Tax 2025. The total sales tax rate in bakersfield comprises the california state tax, the sales tax for kern county, and any applicable special or district taxes. The sales tax in california is 6.00%.

Kern county, located in southern california, has sales tax rates ranging from 8.25% to 9.50%. The sales tax rate for kern county was updated for the 2025 tax year, this is the current sales tax rate we are using in the.

(kero) — measure k took effect in april 2025, and close to a year later that one cent increase in sales tax has generated $39.8 million so far.

Kern County to look at 1 sales tax to unincorporated areas, The different sales tax rates like state sales tax, county tax rate and city tax rate in kern county are 6.00%, 0.25% and 1.00%. The current sales tax rate in kern county, ca is 9.5%.

set for Kern County Sales Tax initiative KGET 17, The maximum sales tax applicable in kern county, california reaches 8.25%. We’ll explain things like the difference between the kern county sales tax rate and the sales tax rates in individual cities in the county, how to calculate sales tax in.

Kern County Board of Supervisors propose 1 sales tax increase, For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate for kern county was updated for the 2025 tax year, this is the current sales tax rate we are using in the.

Measure N sales tax priorities released by Grand Jury, Check sales tax rates by cities in kern county. The city also imposes an.

Kern County Board of Supervisors propose 1 sales tax increase, California has a 6% sales tax and kern county collects an additional 0.25%, so the minimum sales tax rate in kern county is 6.25% (not including any city or special district. To improve county services in the unincorporated area of kern county including public safety and protection, parks, code enforcement, roads and libraries,.

One percent sales tax measure for unincorporated Kern, The different sales tax rates like state sales tax, county tax rate and city tax rate in kern county are 6.00%, 0.25% and 1.00%. The sales tax in california is 6.00%.

Kern County CA 2025 Tax Sale Over 1,500 Properties! Deal of the, The county of kern has proposed a 1% sales tax increase on all unincorporated areas of kern county. To improve county services in the unincorporated area of kern county including public safety and protection, parks, code enforcement, roads and libraries,.

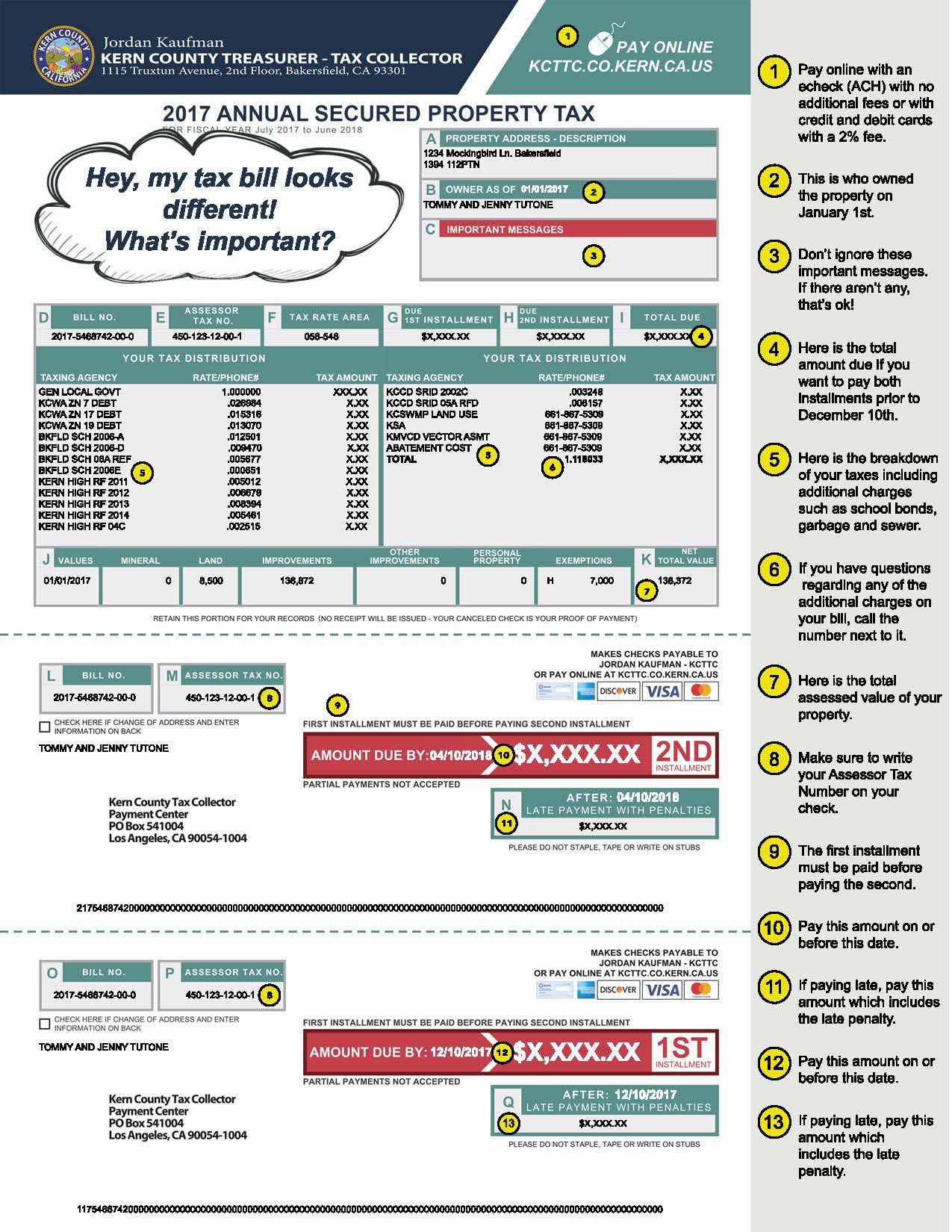

Kern County Treasurer and Tax Collector, The average cumulative sales tax rate in kern county, california is 8.29% with a range that spans from 7.25% to 9.5%. Kern county tax jurisdiction breakdown for 2025.

![Kern County Property Tax [2025] 🪙 Bakersfield & Kern County Property](https://mentorsmoving.com/wp-content/uploads/2023/01/Kern-County-property-Tax-Guide-2-1536x864.png)

Kern County Property Tax [2025] 🪙 Bakersfield & Kern County Property, The different sales tax rates like state sales tax, county tax rate and city tax rate in kern county are 6.00%, 0.25% and 1.00%. Kern county, ca sales tax rate.

County sales tax up from last year, Kern county, located in southern california, has sales tax rates ranging from 8.25% to 9.50%. Check sales tax rates by cities in kern county.